Does homeowners insurance cover faulty wiring? It often depends on the cause. Most policies cover damage caused by faulty wiring, like a fire, but won’t pay for outdated or poorly maintained wiring as a preventive measure.

Knowing what your homeowners insurance covers for electrical issues is crucial. This guide will help you understand what’s included and what’s not. It’s all about protecting your home from electrical mishaps.

Understanding Electrical Wiring Coverage in Home Insurance

Your homeowners insurance is key to protecting your home. It’s important to know how it covers electrical wiring issues. This knowledge helps ensure you’re covered if electrical problems arise.

Types of Electrical Problems Covered

Homeowners insurance usually covers many electrical issues. These include:

- Damage caused by electrical fires

- Electrical system malfunctions leading to power surges or outages

- Wiring issues resulting in electrical shocks or hazards

- Necessary repairs or replacements of faulty or outdated wiring

Standard Coverage Limitations

Even with insurance, there are limits to what’s covered. Policies often cap electrical repair coverage at $1,000 to $5,000. You might also need to pay a deductible before insurance kicks in.

Policy Exclusions for Wiring Issues

It’s vital to read your policy closely. Some electrical wiring problems aren’t covered. These might include:

- Damage caused by negligence or lack of maintenance

- Issues arising from outdated or non-compliant wiring installations

- Gradual deterioration of wiring due to age or environmental factors

Knowing your policy well helps you deal with electrical wiring issues. It ensures you have the right coverage.

Does Homeowners Insurance Cover Faulty Wiring?

Homeowners insurance can be tricky when it comes to faulty wiring. Many policies do cover electrical damage, but what’s included can vary a lot. It’s key to know what your policy covers to make sure you’re protected against faulty wiring coverage and electrical damage claims.

Usually, insurance will help with sudden and accidental wiring damage, like fires or power surges. This includes fixing the wiring and any damage it causes. But, it might not cover slow wiring wear or problems from bad installation or upkeep.

- Sudden and accidental electrical damage, like a fire or power surge, is often covered.

- Gradual wear and tear or issues due to poor installation or maintenance may be excluded.

- Policy limitations and exclusions can vary, so it’s essential to review your coverage details.

Remember, your homeowners insurance policy will tell you how much it covers for faulty wiring and electrical damage claims. Take the time to read your policy carefully and talk to your insurance agent. This way, you’ll know exactly what you’re covered for and can keep your home’s electrical system safe.

Common Causes of Electrical Problems in Homes

Many things can cause electrical issues in homes. These include old wiring and environmental factors. Knowing what causes these problems helps homeowners fix them quickly and avoid bigger issues.

Age-Related Wiring Deterioration

Older homes often have worn-out electrical wiring. This can lead to electrical issue causes. Older homes might have wiring that frays, cracks, or fails completely.

Poor Installation and Maintenance

Bad installation or no maintenance can also cause problems. Shoddy work or low-quality materials can weaken the electrical system. Not checking or fixing things regularly can make things worse.

Environmental Factors

Environmental factors can also harm wiring. Moisture, extreme temperatures, or pests can damage it. For example, rodents chewing on wires or water getting in can cause short circuits.

Knowing why electrical problems happen helps homeowners keep their systems working well. They can fix issues before they get worse and cost more.

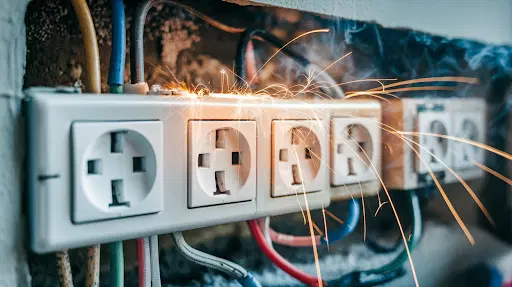

Signs of Faulty Wiring That Require Immediate Attention

Keeping your home’s electrical system safe is key. Spotting faulty wiring signs early can prevent big problems. This way, you can keep your family and home safe from electrical dangers.

Frequent circuit breaker tripping or blown fuses are common signs. These happen when your wiring can’t handle the electrical load. It’s a clear electrical hazard sign.

Also, flickering or dimming lights are warning signs. They can mean loose connections or voltage issues. These faulty wiring symptoms should not be ignored.

Warm or discolored outlets, switches, or light fixtures are other signs. They might mean overheating due to wiring problems. Ignoring these home safety issues can lead to fires.

If you see any of these signs, call a qualified electrician right away. Ignoring faulty wiring symptoms can cause serious damage. It could even risk your family’s safety.

When Insurance Companies May Deny Wiring Claims

Many homeowners think their insurance will cover electrical problems. But, insurance companies might deny wiring claims in some cases. Knowing why they deny claims can help you get the coverage you need.

Negligence and Maintenance Issues

Insurance companies often deny claims if they find negligence or poor maintenance. If they think the homeowner didn’t take care of the electrical system, they might say the damage wasn’t covered.

Code Violations and Compliance Problems

Insurance policies usually don’t cover damage from wiring claim rejections that break local building codes. If an inspection shows the electrical system doesn’t meet code, the insurer might deny the claim. They say it’s the homeowner’s job to keep the property safe.

Documentation Requirements

When you file a claim for electrical issues, you need to have all the right documents. Insurers want to see records of maintenance, repairs, and inspections. Without these, your claim could be denied.

Knowing the risks and working with your insurer can help you get your claim approved. This way, your home’s electrical system will be well-protected.

Steps to File a Claim for Electrical Damage

If your home has electrical damage, like faulty wiring or power surges, filing an insurance claim can seem hard. But, by following a few steps, you can improve your chances of a successful claim. Let’s look at the key parts of filing an insurance claim for wiring problems.

- Thoroughly document the damage: Collect proof of the wiring damage, like photos, detailed descriptions, and repair estimates. This evidence is key for your insurance claim process.

- Notify your insurance provider: Call your homeowners or renters insurance right away to report the damage. Be ready to share all the details and evidence.

- Comply with policy requirements: Read your insurance policy to know what’s covered and what’s needed for electrical damage claims. Follow the insurer’s steps for filing the claim and giving the needed info.

- Communicate effectively: Keep talking openly with your insurance provider during the insurance claim process. Answer quickly to any requests for more info or documents.

- Consider hiring a public adjuster: If you’re having trouble or disagreements with your insurance, think about getting a public adjuster. They can help you through the claims process.

By following these steps, you can boost your chances of a successful electrical damage claims process. This way, your home’s electrical system can be fixed properly.

Preventive Measures to Protect Your Home’s Electrical System

Keeping your electrical system in top shape is key. It ensures your home’s wiring and electrical system are safe. By taking early steps, you can avoid electrical problems and keep your home safe.

Regular Inspection Schedule

Start by setting up a regular check-up schedule for your home’s electrical system. It’s wise to have a skilled electrician or home inspector look over your wiring and electrical parts every 3-5 years. They should check:

- Outdated or damaged wiring

- Grounding and circuit breaker work

- Overloading or voltage problems

- Signs of rodent or pest damage

Professional Maintenance Tips

Regular checks are just the start. Ongoing professional maintenance is also crucial. This includes:

- Annual tune-ups with a licensed electrician

- Replacing old or worn-out parts like outlets and switches

- Upgrading to newer, energy-saving systems

- Fixing any issues or code problems quickly

By taking these steps, you can safeguard your home’s electrical system. You’ll also keep your home wiring protection in good shape. This ensures your homeowner’s insurance covers any electrical damage.

Conclusion

We’ve looked at how important homeowners insurance is for your home’s electrical system. It covers faulty wiring and helps spot potential problems. Keeping your electrical system safe is key for your home’s security and your wallet.

Being proactive with inspections and maintenance tips can protect your electrical system. This not only keeps your homeowners insurance coverage strong. It also ensures your electrical system protection and wiring maintenance importance for your home.

Understanding homeowners insurance and electrical maintenance is crucial. Stay informed, work with trusted experts, and keep your wiring in great shape. With effort, you can ensure your home is safe and your family is protected.

FAQ

Does homeowners insurance cover faulty wiring?

Homeowners insurance might cover some wiring issues, but it depends on your policy. Always check your policy to see what’s covered.

What types of electrical problems are typically covered by homeowners insurance?

Insurance usually covers sudden damage like fires or lightning strikes. But, it might not cover slow wear and tear or maintenance issues.

Are there any standard coverage limitations or policy exclusions for wiring issues?

Yes, policies often have limits or exclusions for wiring. For example, they might not cover updates to meet building codes. Or, they might not cover damage from DIY work or neglect.

What are the most common causes of electrical problems in homes?

Common causes include old wiring, bad installation, and weather damage. Rodents can also cause problems.

What are the signs of faulty wiring that require immediate attention?

Look out for tripped circuit breakers, flickering lights, and burning smells. Warm or discolored outlets are also signs. These need quick action to avoid fires or other dangers.

When might an insurance company deny a wiring-related claim?

Claims might be denied for negligence, poor maintenance, code issues, or missing documents. Keeping good records and following protocols can help.

What steps should I take to file a claim for electrical damage?

Start by gathering all your documents and photos of the damage. Then, call your insurance right away. Be ready to explain what happened and work with them.

How can I prevent electrical issues and maintain my home’s wiring system?

Regular inspections and proper maintenance are key. Fixing problems quickly and keeping up with codes can prevent issues. This keeps your home safe and insurable.